Lloyd’s has a long and illustrious history of maritime and cargo insurance. Our global cargo business has grown significantly as international trade has increased and in 2016 we wrote almost £1 billion in cargo premiums – 8.3% of the global cargo insurance market.

However, the performance of the cargo insurance market has deteriorated in recent years pushing the market’s combined ratio above 100%. Cargo insurers are facing multiple challenges, including underlying economic conditions, capacity changes, trends in misappropriation claims, changing terms and conditions and growing risk aggregations.

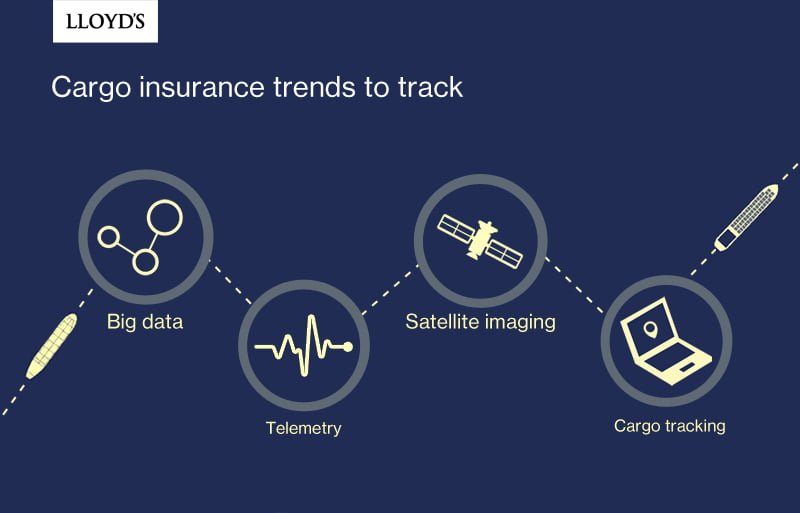

This report analyses cargo insurance trends in the Lloyd’s market, and uses past and present strategies for managing cargo risk accumulations to identify good practice. It aims to help underwriters develop a greater understanding of static in-the-course-of-transit cargo and in-transit cargo risk and improve their modelling of it. The report also considers how innovations including statistical forecasting, big data, telemetry and high resolution satellite imaging could improve risk modelling and potentially help with risk selection.